Government vs Private Mints

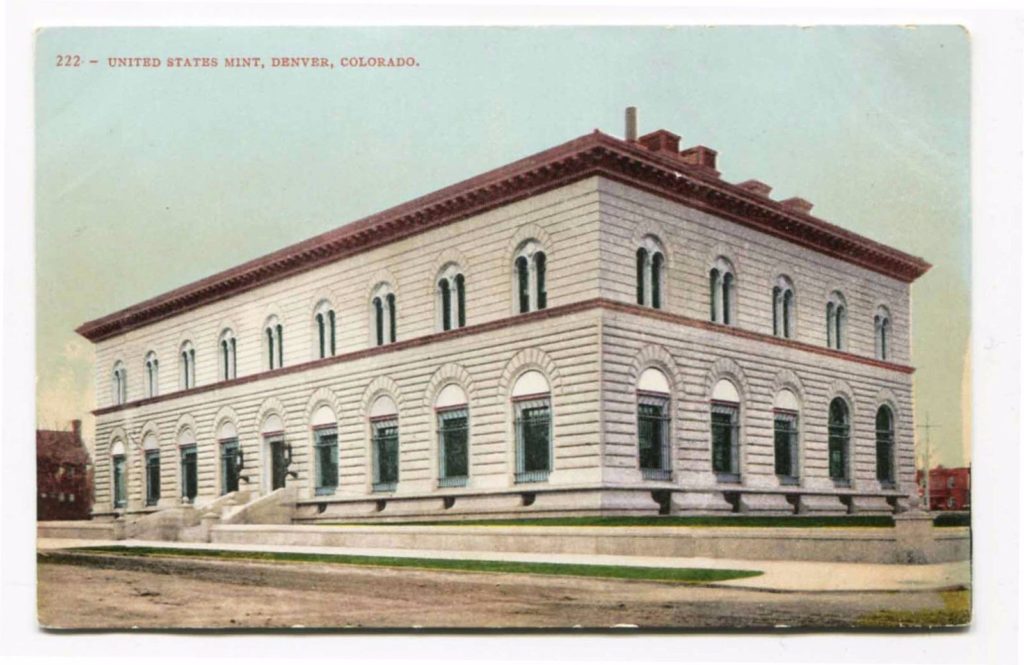

There are two major categories of mints; government and private mints. When one typically thinks of a mint in the United States he or she may picture something like the image above. This is an old postcard featuring the mint facility in Denver, Colorado, which still exists today. Government-backed facilities are also called sovereign mints. Private sector mints create coin-looking products which are called rounds. Rounds may be the same size and shape as coins, but without a legally-enforceable face value. The private sector may also create other items that are sold as investments.

They sell items such as gold and silver bars, statues, bullets, and an assortment of silver shapes. Private mints are run like any other business with profits and losses. They are not sanctioned by the government to create legal tender, and are not funded through taxes. Often these private businesses sell their products wholesale to retailers or directly to the public via an ecommerce website.

Government Mints

Countries all over the world have their own mints. These mints create not only create precious metal-based coinage, but base metal coins. Copper, zinc, and nickel are used to form coinage in the U.S. and other countries. The major difference between private and government mints is enforceability of the arbitrary face value of the coins they create. In the U.S., in particular, there are six major facilities called “mints,” however they don’t all strike coinage. Some of these facilities only handle functions such as policy formation, marketing, and other necessary administrative tasks. US Mint facility locations include:

- US Mint at Denver

- US Mint at Philadelphia

- US Mint at San Francisco

- US Mint at West Point

- Fort Knox

- Washington D.C.

Outside of the general circulating currency, government mints can and do create precious metal coins which hold an arbitrary face value. These coins often bear a face value less than the spot value of the metal. For example, the Perth Mint and Royal Canadian Mint are each quite prolific in producing gold and silver bullion coinage. The Perth Mint’s Lunar Series is a collection of different faces on silver bullion coins that each hold a face value of $1 AUD. However, the melt value changes based on the price of silver, and the collector value changes based on mintage (supply)/demand and other factors. One might end up paying $40 AUD for a $1 coin. Â The same goes for Canadian Maple Leafs – these coins hold a $5 CAD value, but typically sell for a couple of dollars over spot value of silver.

More on Government Mints

At one time, most coins held some sort of precious metal. However, over the years coins have become produced with less and less precious metal content for circulated currency. The reason being is Gresham’s law – precious metal coins are hoarded and coins with less intrinsic value are circulated.

Government mints are going to fall under a higher level of scrutiny when it comes to exact specifications of coins. Any mistakes made can cause the resulting coin to be worth much more than the face value to collectors. The hidden tax and choice of governments to not create circulated coinage with precious metals does not stop the production of keepsakes and same year collections. Seigniorage is the term for profit made by governments for selling coins as a collection for more than their face value. The U.S. government creates one-year collections of coins produced that year. Sometimes it will contain a partially silver coin.

Mint and Proof Sets have been a source of income for the U.S. government for 60 or 70 years. A recent example is the 50 State Quarters collection. Sometimes the collection will contain coins not typically silver but made so for the set, like Kennedy Half-Dollar and Washington Quarter Dollar.

Mintmarks

A signifying letter on a coin shows where it was struck. A “D” means the coin was minted in Denver, Colorado, “S” in San Francisco, California, “P” Pennsylvania, etc. This designation is called the mintmark. For other foreign coins, they often make it quite apparent which monarch and rule the coin falls under with many featuring the side profile of Queen Elizabeth. Some other popular world mints that serve not only their only countries, but others buying their bullion products include The British Royal Mint, Royal Canadian Mint, Bavarian State Mint, Mexican mint, and others. Here is an expansive list of world government mints.

Worldwide & U.S. Private Mints

Now “mint,” although a small word indicates a large operation. Some “mints” use the word in their name although they may have just started as a silversmith hobbyist with a small forge, smelter, or foundry to melt silver. These “mints” are usually created by collectors/investors of other mints’ products that may have decided there must be a way to create their own and turned his/her hobby into a business. What may start as a few melted bars from scrap silver may turn into a full industrial operation. Mints may come and go because like with every business there are startup costs, investors, and marketing costs involved. Emerging private mints become known via collectors in the market.

More on Private Mints

Once a private mint is listed as a vendor on a major retailer, a buyer can trust that vendor to be highly reputable. If you are the type that does not mind taking a chance, seek out your own private mints and order direct. Most major credit cards, like American Express, will protect you from any fraud in case the business is not able to fulfill your order. Often, there will be upcharge for using a credit card and not a bank wire or check. If it’s substantial order, and it’s your first time, it would be well worth using this method.

- Â A-Mark

- Atlantis Mint

- Engelhard

- Heraeus Precious Metals

- Monarch Precious Metals

- Prospector’s Gold & Gems

- Silvertowne

- ABC Bullion

- Baird & Co.

- Geiger Edelmetalle

- Johnson Matthey

- Ohio Precious Metals

- Provident Metals

- Sunshine Minting

- Asahi Refining

- Elemetal

- Golden State Mint

- MK Barz

- Pamp Suisse

- Scottsdale Mint

- Valcambi

You can get some recommendations of non-vetted private mints by silver stackers showing off his/her collection via social platforms such as YouTube. Often, self identified “silver stackers” that publish videos on a regular basis enjoy “discovering” a mint. Similar to a new band or restaurant,  the novelty value of having a unique shape of silver first can be irresistible. Becoming the envy and receiving affirmation from your peers might even be the secondary goal.  Some of these private mints have been around for more than 60 years, and are highly trusted, even more so than purchasing directly from the U.S. Mint. To get some ideas on products see this expansive list of private mints.

Content last updated on Jan. 1st, 2023